Capital Gains Tax Allowance 2025 26 Gov Uk. Capital gains tax (cgt) is charged on the profits made from selling assets, such as investments or valuable possessions. From the 2025 to 2026 tax year there will be no additional burdens as the.

Uk Capital Gains Tax Allowance 2025 Dyane Grethel, With increases in tax rates and reductions in the annual exempt amount (aea), more people will be required to report and pay cgt.

Capital Gains Tax 2025/2025 2025 Uk Happy Kirstyn, It’s the gain you make that’s taxed, not the amount of money you.

What Is the Capital Gains Tax Allowance for 2025/25?, Executors/estates pay cgt at the higher.

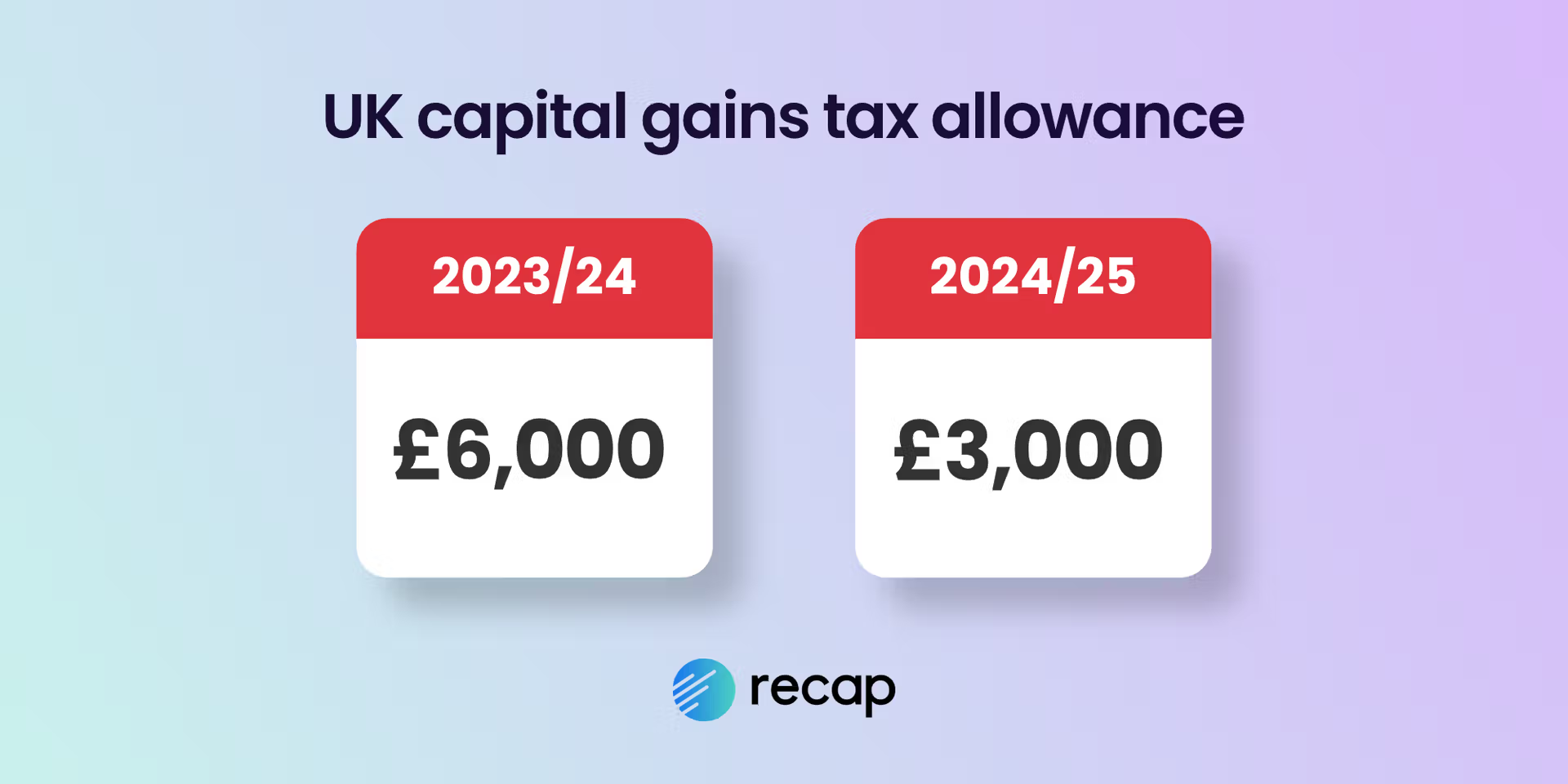

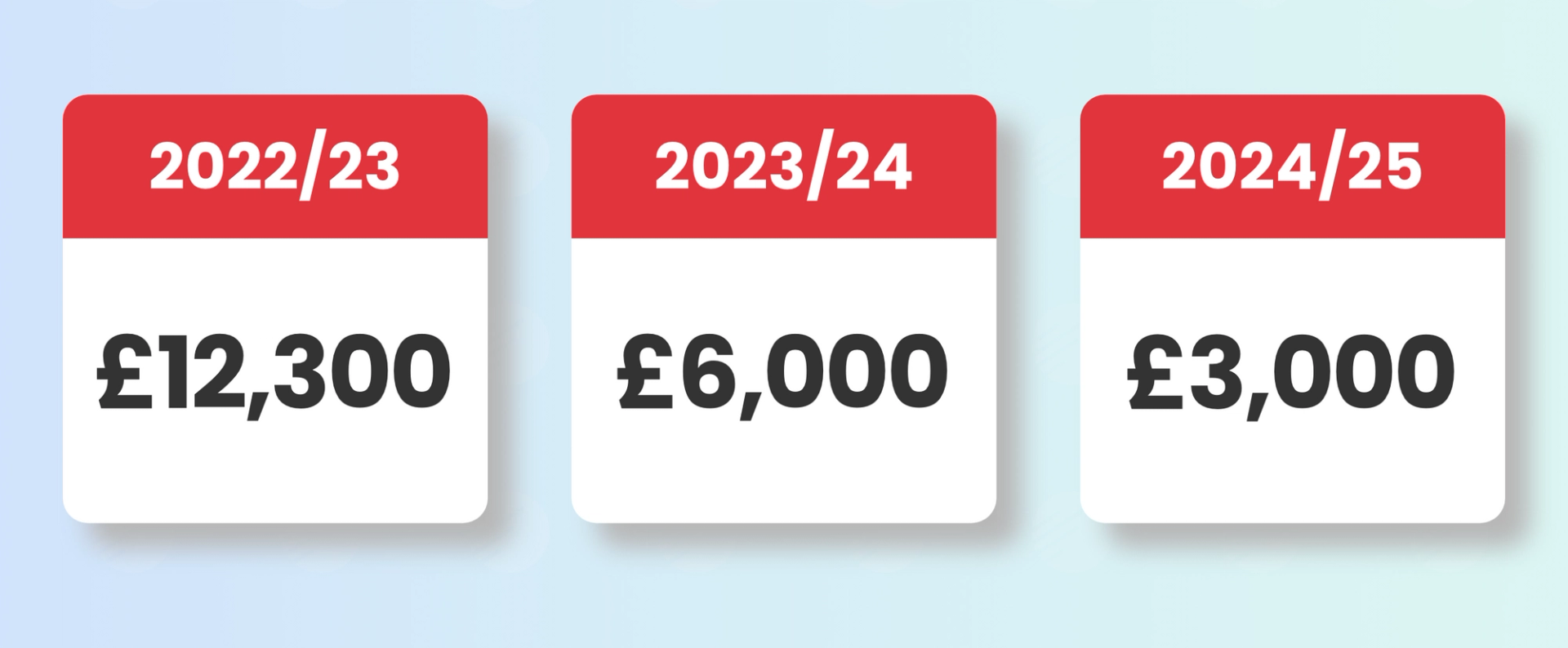

Capital Gains Tax 2025 Allowance Uk Andi Madlin, This means you can make gains of up to £3,000 in the tax year before you.

Understanding the UK Capital Gains Tax Allowance Reduction Blog, For the 2025/25 and 2025/26 tax year, the capital gains tax (cgt) allowance in the uk is £3,000.

What Is Capital Gains Tax Rate For 2025 Uk Megan Knox, Capital gains tax (cgt) is charged on the profits made from selling assets, such as investments or valuable possessions.

Paying Tax on Crypto in the UK What to Know About Capital Gains Taxes, For the 2025 to 2025 tax year the allowance is £3,000, which leaves £9,600 to pay tax on.

Uk Tax Year 2025 2025 Image to u, From april 2025, the capital gains tax (cgt) rate for carried interest will rise from 28% to 32%, aligning with the higher income tax rate.